Cosmetic Dentistry Market Size, Share & Trends Analysis Report By Product (Dental Systems & Equipment, Dental Implants, Dental Crowns & Bridges), By Region, And Segment Forecasts, 2022 - 2030

- Report ID: 978-1-68038-951-7

- Number of Pages: 100

- Format: Electronic (PDF)

- Historical Range: 2018 - 2020

- Industry:Healthcare

Report Overview

The global cosmetic dentistry market size was valued at USD 29.6 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 13.0% from 2022 to 2030. With an increasing population opting for the improvement of dental aesthetics, this industry has undergone great advancements. Cognizance among the population about such techniques and procedures has allowed this industry to prosper by leaps and bounds. Developing countries have generated a large amount of disposable income, which is the main reason why cosmetic dentistry is flourishing. The geriatric population, in general, has propagated the growth of this industry, owing to old age-related tooth ailments. Treatments that include teeth whitening, changes in dental appearance, and malocclusion are the most frequent procedures that patients undergo in cosmetic dentistry. Dental tourism has been an important reason that has caused cosmetic dentistry to prosper globally.

COVID-19 has significantly impacted the market and the business of various market players. The pandemic has resulted in supply chain disruptions such as cost inflation, shortages of supply, and shipping delays. The COVID-19 pandemic has also increased the financial burden of market players in terms of labor availability, which has resulted in an increase in labor costs. However,telemedicine成为一个福音牙科医生和病人s. With ease in COVID-19 restrictions in different regions, the market players are able to continue their operations at a lucrative growth rate in terms of sales and profits. For instance, Danaher Corporation has witnessed 8% sales growth in 2021 compared to 2020.

Product Type Insights

Dental systems and equipment accounted for the largest revenue share of over 30.0% in 2021. This is attributed to their wide range of applications in the dental industry. Based on the product, the industry is segmented into dental systems and equipment, dental implants,dental crowns and bridges,dental veneers, orthodontic braces, bonding agents, inlays and onlays, and whitening.

Dental systems and equipment include a variety of arrangements like instrument delivery systems,dental chairs、牙科机头、光固化equipment, dental scaling units, dental CAD/CAM systems, dental lasers, and dental radiology equipment. With the increase in the population wanting to improve dental aesthetics, the use of orthodontic braces comprising fixed and removable braces has increased rapidly.Dental implantscomprising titanium implants and zirconium implants are also used on a large scale in individuals who are recovering from disfigurations and accidents.

The orthodontic braces segment is expected to exhibit the highest growth rate of 27.4% in the forecast period. The campaigns and activities such as Oral Health Foundation's initiatives National Smile Month, Dental Buddy, and others are creating awareness about dental products, dental health, and appearance, thereby facilitating segment growth.

Regional Insights

North America dominated the market for cosmetic dentistry and held a share of over 40.0% in 2021. This is attributed to technological advancements and an increase in the number of individuals opting for procedures involved in cosmetic dentistry. Moreover, factors like high acceptance and openness toward aesthetic treatments and growing appearance consciousness are likely to propel the market growth in the region.

North America is further expected to exhibit the highest growth rate in the forecast period. This can mainly be attributed to factors like high personal disposable income. According to data published by the U.S Bureau of Economics, in April 2020, personal income increased by USD 1.97 trillion (10.5%) and Disposable Personal Income (DPI) increased by USD 2.13 trillion. Moreover, the increasing expenditure on healthcare, availability of certified professionals, well-built healthcare infrastructure, and easy access to aesthetic services are key growth factors.

Key Companies & Market Share Insights

Most companies are involved in the modification of already launched products, thereby enhancing their product portfolios. Consolidated partnerships between companies in this industry are a frequent phenomenon to keep ahead of other competitors. For instance, in March 2019, Align Technology, Inc. announced a distribution agreement for iTero Element Intraoral Scanners with Benco Dental, which is the largest privately-owned dental distributor in the U.S. The company’s iTero Element scanner can help dentists perform a wide range of restorative and orthodontic procedures with greater precision and visualization capabilities. Some prominent players in the global cosmetic dentistry market include:

Danaher Corporation

Align Technology Inc.

Dentsply International, Inc.

3M Company

Zimmer Biomet Holding, Inc.

Institut Straumann AG

Sirona Dental Systems, Inc.

Biolase, Inc.

Planmeca Oy

A-dec Inc.

Cosmetic Dentistry MarketReport Scope

Report Attribute |

Details |

Market size value in 2022 |

USD 33.6 billion |

Revenue forecast in 2030 |

USD 89.0 billion |

Growth rate |

CAGR of 13.0% from 2022 to 2030 |

Base year for estimation |

2021 |

Historical data |

2018 - 2020 |

Forecast period |

2022 - 2030 |

Quantitative units |

Revenue in USD million/billion and CAGR from 2022 to 2030 |

Report coverage |

Revenue forecast, competitive landscape, growth factors, and trends |

Segments covered |

Product type, region |

Regional scope |

北美;欧洲;亚太地区;拉丁美洲; MEA |

Country scope |

U.S.; Canada; U.K.; Germany; France; Italy; Spain; China; India; Japan; Australia; Brazil; Mexico; South Africa; Saudi Arabia; UAE |

Key companies profiled |

Danaher Corporation; Align Technology Inc.; Dentsply International, Inc.; 3M Company; Zimmer Biomet Holding, Inc.; Institut Straumann AG; Sirona Dental Systems, Inc.; Biolase, Inc.; Planmeca Oy; A-dec Inc. |

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scope. |

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs.Explore purchase options |

Global Cosmetic Dentistry Market Segmentation

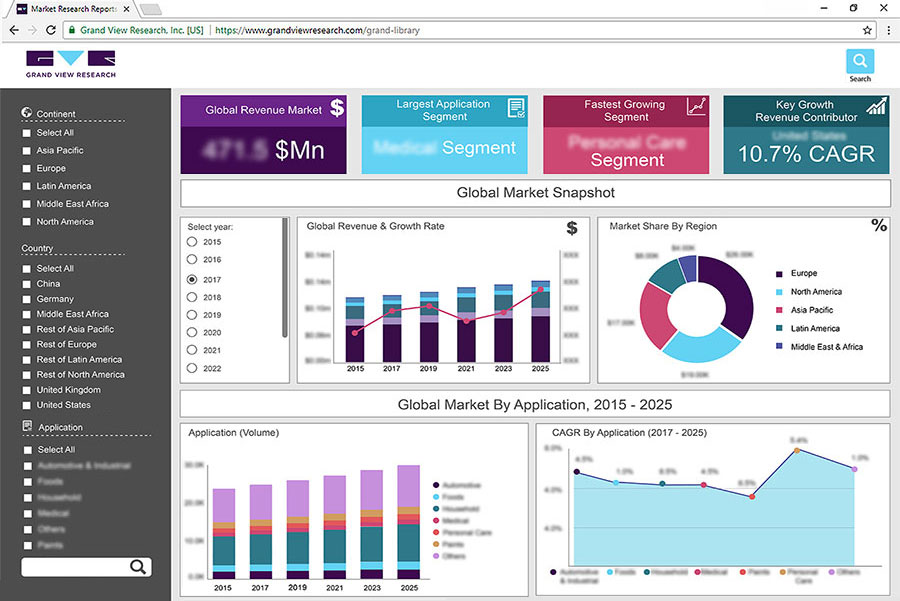

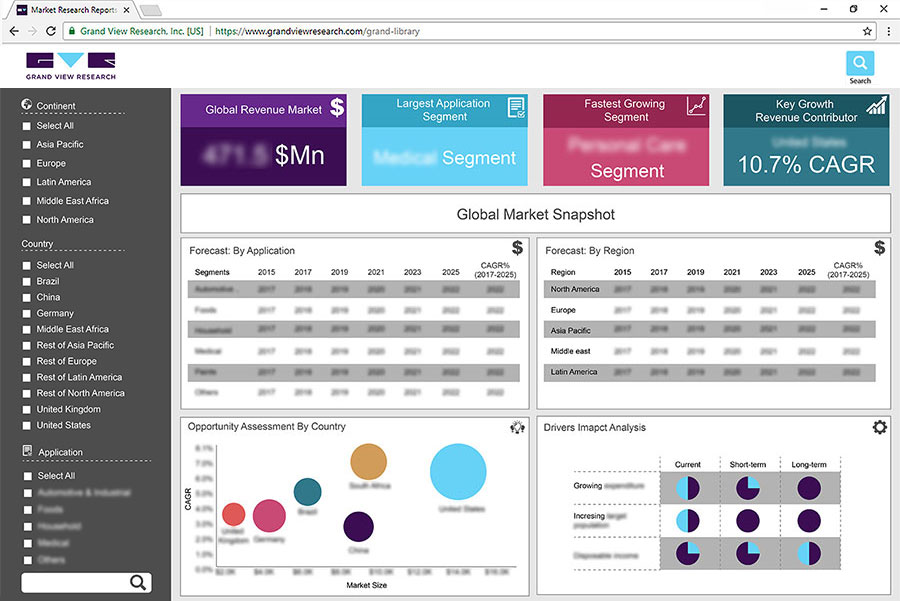

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global cosmetic dentistry market report on the basis of product type and region:

Product Type Outlook (Revenue, USD Million, 2018 - 2030)

Dental Systems & Equipment

Instrument Delivery Systems

Dental Chairs

Dental Handpieces

Light Curing Equipment

Dental Scaling Units

Dental CAM/CAD Systems

Dental Lasers

Dental Radiology Equipment

Dental Implants

Dental Crowns & Bridges

Dental Veneer

Orthodontic Braces

Bonding Agents

Inlays & Onlays

Whitening

Regional Outlook (Revenue, USD Million, 2018 - 2030)

North America

U.S.

Canada

Europe

Germany

U.K.

France

Italy

Spain

Asia Pacific

Japan

China

India

Australia

拉丁美洲

Brazil

Mexico

MEA

South Africa

Saudi Arabia

UAE

Frequently Asked Questions About This Report

b.The global cosmetic dentistry market size was estimated at USD 29.6 billion in 2021 and is expected to reach USD 33.6 billion in 2022.

b.The global cosmetic dentistry market is expected to grow at a compound annual growth rate of 13.0% from 2022 to 2030 to reach USD 89.0 billion by 2030.

b.North America dominated the cosmetic dentistry market with a share of 40.2% in 2021. This is attributable to rising technological advancement and an increase in the number of individuals opting for procedures involved in cosmetic dentistry.

b.Some key players operating in the cosmetic dentistry market include Danaher Corporation, Align Technology Inc. Dentsply International, Inc., 3M Company, Zimmer Biomet Holding, Inc. Institut Straumann AG, Sirona Dental Systems, Inc., Biolase, Inc., Planmeca Oy, and A-dec Inc.

b.Key factors that are driving the cosmetic dentistry market growth include increasing consumer awareness, growing focus on aesthetics, Escalating middle-class population and increasing disposable income in developing countries, and increasing dental tourism in emerging markets.