在sulin Pump Market Size, Share & Trends Analysis Report, By Type (Patch, Tethered), By Accessories (Insulin Reservoir Or Cartridges, Insulin Set Insertion Devices, Battery), By End-use, By Region, And Segment Forecasts, 2021 - 2028

- Report ID: GVR-3-68038-876-3

- Number of Pages: 165

- Format: Electronic (PDF)

- Historical Range: 2016 - 2019

- 在dustry:Healthcare

Report Overview

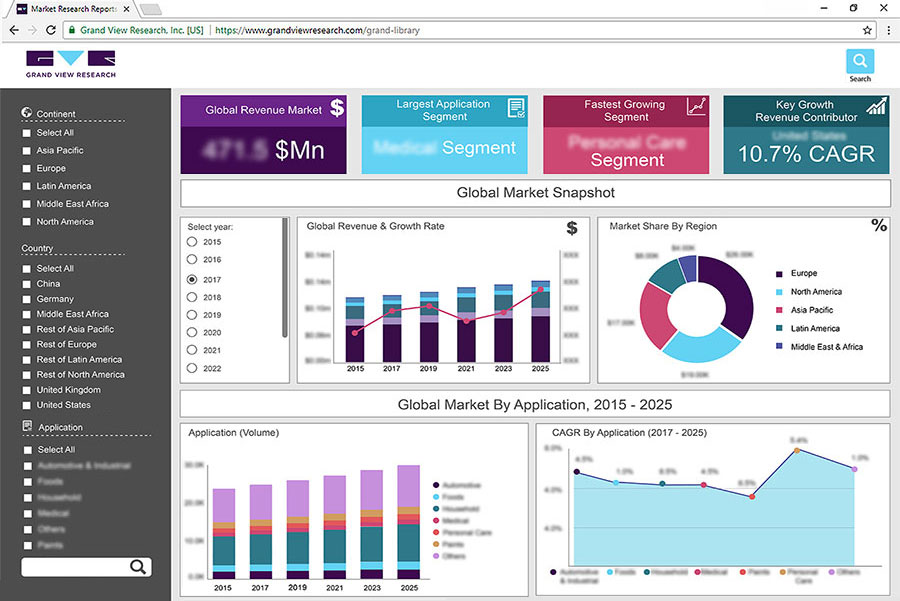

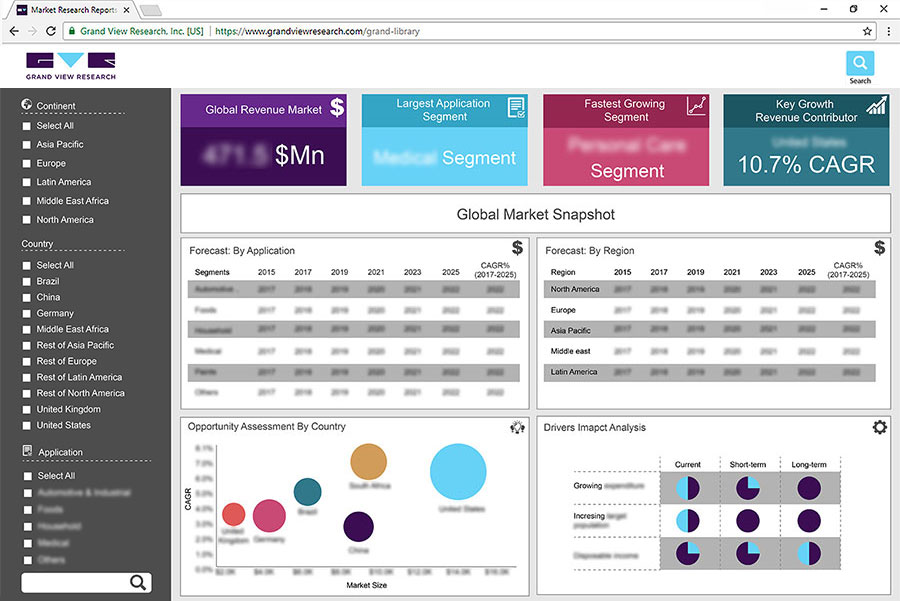

The global insulin pump market size to be valued at USD 8.3 Billion By 2028 and is expected to grow at a compound annual growth rate (CAGR) of 8.7% during the forecast period. The factors influencing market growth include technological advancements and the rising adoption of insulin pumps over traditional methods. Insulin pumps are very convenient for people who require multiple insulin injections on a daily basis. These devices are less invasive and hence, are largely adopted by the patient pool. The growth of the market is majorly attributed to the increasing geriatric population, growing incidence of diabetes, and the rising prevalence of obesity. Moreover, companies are developing new generation insulin pumps with advanced technology to provide better compliance and integration with IT devices, which is contributing to the growth of the market. Technological developments, including artificial pancreas and home infusion therapy are also anticipated to create significant growth opportunities in the near future. Furthermore, increasing awareness about insulin pumps and their use has also led to market growth in both developed and developing countries.

糖尿病的发病率的增加由于ag)ing, obesity, and an unhealthy lifestyle is one of the factors contributing to the growth of the market. Obesity is a major factor causing diabetes leading to the increased incidences of diabetes-associated ophthalmic disorders. In 2017, the global incidence of diabetes was reported for around 22.9 million, the prevalence accounted for around 476.0 million, around 1.37 million deaths were reported due to diabetes, and disability-adjusted life-years (DALYs) associated with diabetes were reported to around 1.37 million. According to the WHO, in 2017, over 1.9 billion adults were overweight, of which, around 650 million people were classified as obese. Risk factors, such as obesity and overweight, are leading to an increase in the incidence of type II diabetes. Therefore, risk factors such as smoking, overweight, obesity, and high cholesterol are expected to boost the prevalence of type II diabetes.

Diabetes is a clinical condition where the inability of the pancreas to produce insulin causes decreased glucose levels in the body. The rapidly changing lifestyle such as the consumption of alcohol and smoking are contributing to the rise in the number of diabetes patients, worldwide. Moreover, the growing prevalence of obesity across the globe is another factor contributing to the high prevalence of diabetes. Type 1 diabetes (T1D) requires continuous monitoring of blood glucose coupled with multiple injections of insulin, thereby increasing the scope for the growth of pumps and other insulin delivery devices and glucose monitors.

An insulin pump is a machine that enables insulin to be delivered either manually or automatically. These pumps can be programmed to deliver a specific set of doses and can also deliver a larger set of doses of insulin whenever required, such as before a meal. Patients can connect these devices to their smartphones to calibrate blood glucose readings. People with diabetes face many daily challenges such as knowing what to eat, understanding medical advice, and the impact of food and activity on sugar.

With the increase in awareness regarding diabetes management and care, electronic insulin pumps are being favored by both doctors and consumers. This can be attributed to the fact that new-generation pumps are convenient, safe, and provide accurate results compared to traditional methods. The anytime-anywhere nature of digital technology enables patients to address their health issues by connecting with the healthcare team and sharing data. The aforementioned factors are expected to propel the growth of the market. Furthermore, the increasing number of initiatives being undertaken by governments and nonprofit organizations to increase awareness about diabetes is expected to boost the adoption of insulin pumps used for the treatment.

在sulin Pump Market Trends

The prevalence of diabetes is increasing globally and is one of the leading causes of death, with an increased chance of acquiring a variety of other health issues. The number of people diagnosed with type1 diabetes is also rising thereby, boosting the market growth. Furthermore, the market is driven as people have become more aware of the disease by the growing senior population, and increasingly sedentary lifestyles.

根据国际糖尿病IDF(发现ation) Atlas, diabetes will be responsible for around 6.7 million fatalities in 2021 and the overall number of diabetic patients is predicted to increase by 51% by 2045.

在creasing government initiatives for global awareness about medicare policies and the management of diabetes are also fuelling the market growth. Furthermore, there has been a rise in healthcare spending, and increase in the demand for improved tubeless insulin pumps that are both unobtrusive and user pleasant. This is expected to drive market growth during the forecast period.

Restraints

High long-term expenditures concerned with tubeless insulin pumps are expected to hamper corporate expansion. The high long-term expenses associated with diabetes treatment and care using tubeless pumps affect the adoption rate of these devices in emerging economies. In some countries, poor reimbursement scenarios make it unaffordable for many. Factors such as these are expected to limit the market growth.

The growing popularity of naturopathy across the world, and the enforcement of strict regulations for product approval are other significant barriers that limit the growth of the insulin pumps market.

Type Insights

The tethered pumps segment dominated the market and accounted for the largest revenue share of 78.5% in 2020. The segment is expected to witness a CAGR of 9.5% during the forecast period. Tethered pumps have flexible tubing between the pump and the cannula. The large market size of the segment is majorly attributed to the reliability of these traditional pumps and the number of products available in the market

The patch pump segment is expected to witness a robust CAGR of around 10.0% during the forecast period. Patch pumps are small in size and can be directly attached to the surface of the skin. The high growth rate of the market is majorly attributed to its benefit such as there is no tubing in patch pumps and its remote control may also serve as a blood glucose meter. Moreover, pumps are integrated with calculators that help in determining the exact dosage of insulin required by patients. This helps in reducing the overdosage of insulin and other effects associated with it. These factors are likely to boost the growth of the market during the forecast period.

Product Insights

Medtronic’s MiniMed insulin pumps segment dominated the market and captured the largest revenue share of around 50.0% in 2020 owing to the high adoption rate and advancement in technology. The growth of the MiniMed product line is primarily driven by a strong foothold and regional presence of Medtronic and the launch of its MiniMed 670G system, the world’s first hybrid closed-loop system.

The tandem pump segment is expected to exhibit the highest CAGR of 11.2% during the forecast period. The product is widely accepted for its smaller design, compact size structure, yet capacity to hold around 300 units of insulin pumps. Also, it has been designed user-friendly and convenient for patient use, hence expected to fuel market growth.

Accessories Insights

The insulin set insertion devices segment dominated the market and accounted for the largest revenue share of 41.3% in 2020. The highest market share of this segment is majorly attributed to its use such as in general infusion sets of insulin pumps are changed every two to three days and also the high cost of infusion sets.

The insulin reservoir or cartridges segment is expected to witness a substantial growth rate of CAGR of 9.01% during the forecast period. The growth of the segment is driven by the increasing adoption of tethered pumps. This typically involves loading a cartridge of insulin into the reservoir or drawing insulin from a vial into the reservoir. These reservoirs have a capacity of holding up to 300 units of insulin and do not require a change for at least 2-3 days. The aforementioned factors are expected to drive the growth of the segment.

End-use Insights

The hospitals and clinics segment dominated the market and accounted for the largest revenue share of 44.8% in 2020 and is expected to maintain its dominance over the forecast period. The large share of the segment is attributed to the availability of skilled healthcare professionals, increasing government funding, and rising private sector investment in the healthcare sector.

The homecare segment is expected to witness the fastest CAGR of 9.17% during the forecast period. The growth of the sector is attributed to the increasing awareness about insulin pumps use and high adoption of these products at home due to their ease of use. Moreover, increasing usage of patch pumps which are small in size and are easy to carry is also expected to propel the market during the forecast period.

Regional Insights

北美胰岛素泵市场的主导d captured the largest revenue share of around 46.1% in 2020 owing to the presence of major players in insulin pumps. Furthermore, the increasing prevalence of obesity, high treatment costs, technological advancement, and product launches are also expected to drive the market in the region. Europe is also expected to capture a significant market share over the forecast period, due to an increase in the geriatric population, which is prone to diabetes. Moreover, improvements in its healthcare sector and the implementation of advanced medical products are augmenting the demand for insulin pumps in the region.

Asia Pacific is projected to be a lucrative region for the insulin pumps market. Increasing healthcare funding and government initiatives to spread awareness about diabetes are major factors aiding growth in this region. China is expected to lead the APAC region in 2020 owing to its economic growth and large diabetes population. Furthermore, the adoption of new technology in developing economies is also anticipated to boost the market.

Key Companies & Market Share Insights

Key players are involved in adopting strategies such as mergers and acquisitions, partnerships, and the launch of new technologically advanced products and services to strengthen their foothold in the market. Key players are significantly investing in research and development to manufacture technologically advanced products. For instance, in June 2019, Medtronic announced the partnership with Tidepool to create an interoperable automated insulin pump system. The former plans to launch a new Bluetooth-enabled MiniMed insulin pump, which will be compatible with Tidepool Loop, a hybrid closed loop system for apple users.

Recent Development

On June 2, 2022, Insulet Corporation, a world leader in tubeless insulin pump devices and technology, announced an investment of approximately USD 200 million in its upcoming manufacturing facility in Johor over the next five years. This would produce the company’s Omnipod Insulin Management System as part of its ambition to strengthen its worldwide manufacturing capabilities

在April 2022, Ypsomed announced a collaboration with Abbott and CamDiab to develop an integrated AID (automated insulin delivery) system. The new integrated AID system is being designed to link Abbott's FreeStyle Libre 3 with Ypsomed's MyLife YpsoPump to make a smart, and an automatic procedure for delivering insulin with realistic glucose data

On 3 June 2022, Diabeloop, a world leader in therapeutic AI, and SOOIL Development Company, a leader in superior diabetes therapy announced an agreement for worldwide development at the American Diabetes Association Scientific Sessions. The collaboration is anticipated to establish clinical trials for expanding their cooperation and provide access to their goods to as many patients as possible through new innovative products

Some of the prominent players in the insulin pump market include:

Medtronic plc

Hoffmann-La Roche Ltd

Tandem Diabetic Care, Inc.

在sulet Corporation

Ypsomed

Cellenovo

Sooil Development

Valeritas, Inc

JingasuDelfu Co., Ltd.

在sulin Pump Market Report Scope

Report Attribute |

Details |

Market size value in 2021 |

USD 4.6 billion |

Revenue forecast in 2028 |

USD 8.3 billion |

Growth Rate |

CAGR of 8.7% from 2021 to 2028 |

Base year for estimation |

2020 |

Historical data |

2016 - 2019 |

Forecast period |

2021 - 2028 |

Quantitative units |

Revenue in USD billion and CAGR from 2021 to 2028 |

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

部分覆盖 |

Type, product, accessories, end-use, region |

Regional scope |

北美;欧洲;亚太地区;拉丁美洲; MEA |

Country scope |

U.S.; Canada; U.K.; Germany; France; Italy; Spain; Japan; India; China; Australia; South Korea; Brazil; Mexico; Argentina; Columbia; South Africa; Saudi Arabia; UAE |

关键的公司介绍 |

Medtronic plc; Hoffmann-La Roche Ltd.; Tandem Diabetic Care, Inc.; Insulet Corporation; Ypsomed; Cellenovo; Sooil Development; Valeritas, Inc.; JingasuDelfu Co., Ltd. |

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs.Explore purchase options |

Global Insulin Pump Market Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2016 to 2028. For the purpose of this study, Grand View Research has segmented the global insulin pump market report on the basis of type, product, accessories, end-use, and region:

Type Outlook (Revenue, USD Million, 2016 - 2028)

Patch Pumps

Tethered Pumps

Product Outlook (Revenue, USD Million, 2016 - 2028)

MiniMed (630G, 670G, and VEO)

Accu-Chek (Combo, Insight, and Solo)

Tandem (T: slim X2, G4, T: flex Delivery System)

Omnipod

My Life Omnipod

Others

Accessories Outlook (Revenue, USD Million, 2016 - 2028)

在sulin reservoir or cartridges

在sulin set insertion devices

Battery

End-use Outlook (Revenue, USD Million, 2016 - 2028)

Hospitals & clinics

Homecare

Laboratories

Regional Outlook (Revenue, USD Million, 2016 - 2028)

North America

U.S.

Canada

Europe

Germany

U.K.

France

意大利

Spain

Asia Pacific

China

Japan

在dia

Australia

South Korea

拉丁美洲

Brazil

Mexico

Argentina

Colombia

Middle East & Africa

South Africa

Saudi Arabia

UAE

Frequently Asked Questions About This Report

b.The global insulin pump market size was estimated at USD 4.79 billion in 2020 and is expected to reach USD 4.6 billion in 2021.

b.The global insulin pump market is expected to grow at a compound annual growth rate of 8.74% from 2021 to 2028 to reach USD 8.27 billion by 2028.

b.North America dominated the insulin pump market with a share of 46.08% in 2020. This is attributable to the increasing prevalence of obesity, treatment cost, rising patient awareness about early disease diagnosis and treatment, supportive reimbursement policies, and the increasing prevalence of diabetes.

b.Some key players operating in the insulin pump market include Medtronic plc, Hoffmann-La Roche Ltd, Tandem Diabetic Care, Inc., Insulet Corporation, Ypsomed, Cellenovo, Sooil Development, Valeritas, Inc., and Jingasu Delfu Co., Ltd.

b.Key factors that are driving the insulin pump market growth include rising technological advancement and adoption of insulin pumps over traditional methods.