Medical Waste Containers Market Size, Share & Trends Analysis Report By Product (Chemotherapy, RCRA), By Type Of Waste (General, Infectious, Hazardous), By End-use, By Region, And Segment Forecasts, 2020 - 2027

- Report ID: GVR-4-68039-228-0

- Number of Pages: 90

- Format: Electronic (PDF)

- Historical Range: 2015 - 2018

- Industry:Healthcare

Report Overview

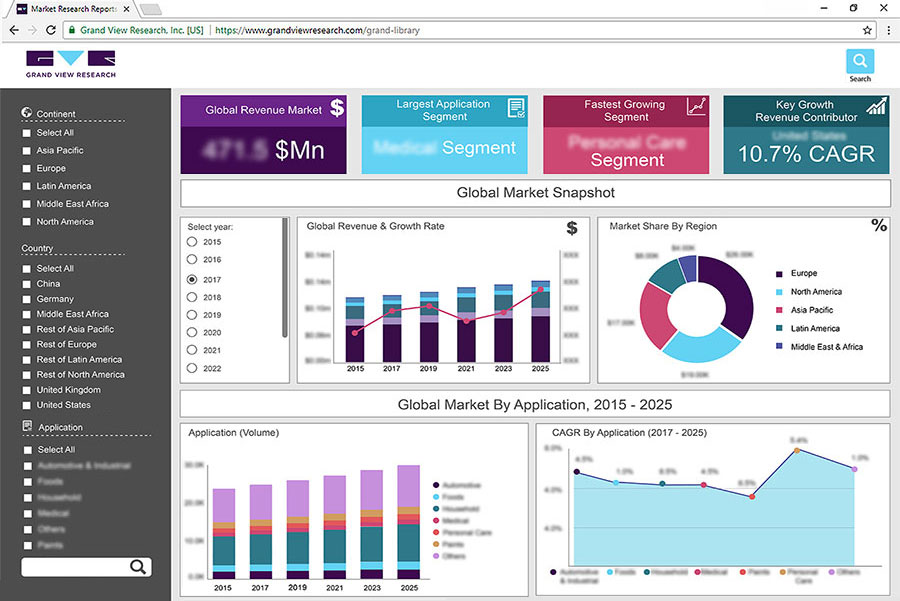

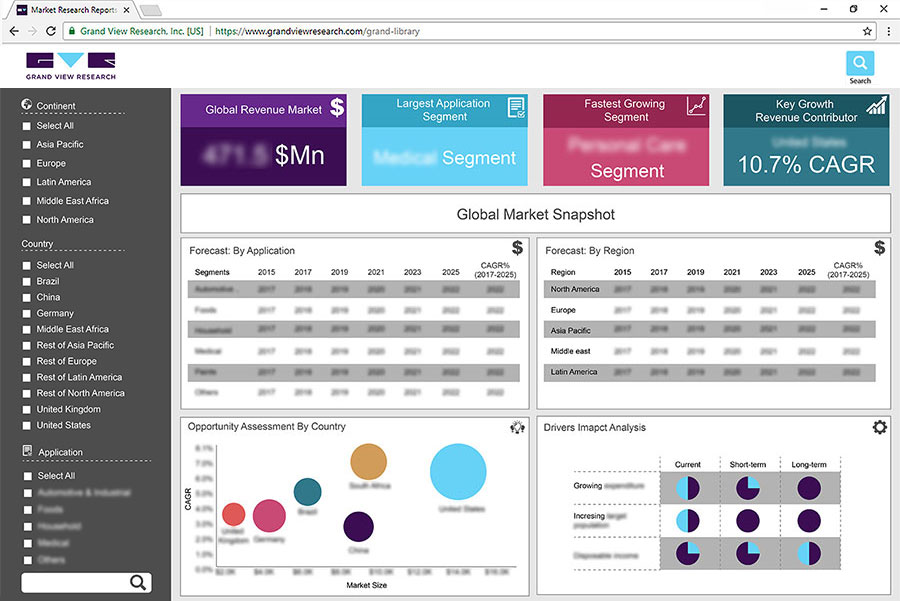

的global medical waste containers market size was valued at USD 1.6 billion in 2019 and is expected to expand at a compound annual growth rate (CAGR) of 6.1% from 2020 to 2027. The increasing demand for medical waste containers is attributed to the rising number of hospitals in developing countries, increasing patient population, the rising volume of diagnostic and lab testing samples, and growing awareness of the benefits of hospital waste management in curbing the spread of infection.

的rising awareness of the benefits of proper management of hospital waste in the healthcare industry of developing countries is also anticipated to increase the demand for the product. Moreover, the increasing use of medical waste containers in the proper disposal of hospital waste is expected to propel market growth over the forecast period.

的increasing incidence of Hospital Acquired Infections (HAIs) due to lack of sanitation and precaution is one of the leading factors contributing to market growth. For instance, as per the CDC, about one in 25 hospital patients contracts at least one HAI every year. The proper disposal of medical waste in medical waste containers provides general protection against contamination and can help lower the risk of contracting HAIs. Furthermore, they also prevent the spread of bacterial and other microbial infections in hospitals and clinics. Thus, these factors are anticipated to propel market growth over the forecast period.

的growing number of surgeries globally is also a key factor expected to drive market growth over the forecast period. For instance, as per Mölnlycke Health Care AB, 70 million surgical procedures are performed every year in Europe. The medical waste generated from surgeries requires proper disposal containers, owing to which the demand for medical waste containers is increasing. According to the Healthcare Cost and Utilization Project (HCUP), in 2015, more than 9,942,000 surgeries were performed in the U.S. within ambulatory care settings. The proper disposal of medical waste prevents the transmission of nosocomial infections to some extent, owing to which, surgeons consistently prefer to use specific medical waste containers for the disposal of products. Such factors are expected to drive the market.

的rising geriatric population across the globe is one of the prominent factors influencing market growth. The geriatric population is more prone to various chronic conditions and chronic wounds, thereby increasing the hospital admission rate. The increasing hospital admission rate is anticipated to increase medical waste, thereby boosting market growth over the forecast period.

Product Insights

的chemotherapy containers segment held the largest market share of 37.9% in 2019 and is anticipated to witness a considerable growth rate over the forecast period. The growth of the segment is majorly driven by the rising cases of cancer and surgeries of cancer patients across the globe. For instance, as per the report published by the World Health Organization in 2018, around 2.1 million cases of lung cancer, 2.1 million cases of breast cancer, and 1.8 million cases of colorectal cancer were reported globally. Such factors are anticipated to drive the demand for chemotherapy containers, thereby propelling segment growth.

的Resource Conservation and Recovery Act (RCRA) containers segment is anticipated to witness the fastest growth rate over the forecast period. The RCRA container is majorly used for the storage of hazardous waste. These containers are less expensive and are less difficult to manage as compared to surface impoundments or tanks. The RCRA containers are movable and allow operators or owners to use only one unit for transportation, disposal, and storage.

End-use Insights

的hospitals and private clinics segment of the medical waste containers market held the largest revenue share of 35.3% in 2019. The increasing cases of chronic wounds and cancer and the rising number of hospital admissions are the major factors driving the segment. In addition, the increasing number of surgical procedures is also anticipated to positively impact segment growth over the forecast period.

的hospital and private clinics segment is also anticipated to witness the fastest growth rate over the forecast period. The increasing number of clinics and surgical procedures are the major factors contributing to segment growth over the forecast period.

Type of waste Insights

的general medical waste segment held the largest market share of 35.4% in 2019. General medical waste majorly includes waste generated from research facilities, healthcare establishments, and laboratories. More than 75.0% of the waste produced from hospitals and clinics comprises general medical waste. General medical waste is governed by municipal waste disposal mechanisms.

的infectious medical waste segment is anticipated to witness the fastest growth rate over the forecast period. Infectious waste generally comprises pathogens (bacteria, viruses, parasites, or fungi) in an adequate concentration or quantity to cause disease in susceptible hosts. The infectious waste majorly comes from waste from isolation wards, tissue or swabs, and laboratory cultures. The recent outbreak of COVID-19 is one of the major drivers for the growth of the segment over the forecast period.

Regional Insights

North America dominated the market and accounted for the largest revenue share of 45.3% in 2019. The region is anticipated to witness a considerable growth rate over the forecast period. An increase in the number of surgeries and healthcare workers is expected to drive the demand for medical waste containers in the region. Major market players in the region are undertaking initiatives to increase the use of medical waste containers by offering innovations and modifications. In addition, increasing cases of hospital-acquired infections and the outbreak of COVID-19 are expected to boost the product demand. All these factors are anticipated to propel market growth in the region over the forecast period.

In the Asia Pacific, the market is expected to witness the fastest growth rate of 6.8% over the forecast period. The presence of developing countries such as China, India, and Japan is anticipated to boost the market growth in the region. Increasing healthcare infrastructure development in this region and the rising awareness about patient safety and hygiene standards are some of the factors anticipated to drive the market. In India, most hospitals have contracts with third parties for medical waste management. The demand for better hygiene in hospitals has increased in this region due to increasing awareness about maintaining hygiene in hospitals and its role in preventing the transmission of various diseases.

Key Companies & Market Share Insights

的key companies are constantly making efforts to commercialize medical waste containers across the globe by emphasizing the benefits of the product. For instance, as per the journal published by the National Center for Biotechnology Information in 2020, separate temporary storage and disposal areas, tanks, and medical waste containers were allotted for COVID-19-related medical waste with a significant warning mark.

Many key players are also implementing strategies such as mergers with material suppliers, government investments in manufacturing, and agreements with hospitals to provide long-term supplies. Some of the prominent players in the medical waste containers market include:

BD

Bemis Manufacturing Company

Mauser Packaging Solutions

Bondtech Corporation

Daniels Sharpsmart Inc. (Daniels Health)

EnviroTain, LLC.

的rmo Fisher Scientific Inc.

Cardinal Health

Henry Schein, Inc.

Sharps Compliance, Inc.

Medical Waste Containers Market Report Scope

Report Attribute |

Details |

Market size value in 2020 |

USD 1.7 billion |

Revenue forecast in 2027 |

USD 2.6 billion |

Growth Rate |

CAGR of 6.1% from 2020 to 2027 |

Base year for estimation |

2019 |

Historical data |

2015 - 2018 |

Forecast period |

2020 - 2027 |

Quantitative units |

Revenue in USD million and CAGR from 2020 to 2027 |

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

Segments covered |

Product, type of waste, end-use, region |

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa (MEA) |

Country scope |

U.S.; Canada; U.K.; Germany; Japan; China; Brazil; Mexico; South Africa; Saudi Arabia |

Key companies profiled |

BD; Bemis Manufacturing Company; Mauser Packaging Solutions; Bondtech Corporation; Daniels Sharpsmart Inc. (Daniels Health); EnviroTain, LLC.; Thermo Fisher Scientific Inc.; Cardinal Health; Henry Schein, Inc.; Sharps Compliance, Inc. |

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope. |

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs.Explore purchase options |

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2015 to 2027. For the purpose of this study, Grand View Research has segmented the global medical waste containers market report on the basis of product, type of waste, end-use, and region:

Product Outlook (Revenue, USD Million, 2015 - 2027)

Chemotherapy Containers

Biohazardous Medical Waste Containers

Resource Conservation and Recovery Act (RCRA) Containers

Others

Type Of Waste Outlook (Revenue, USD Million, 2015 - 2027)

General Medical Waste

Infectious Medical Waste

Hazardous Medical Waste

Others

End-use Outlook (Revenue, USD Million, 2015 - 2027)

Hospitals & Private Clinics

Diagnostic Laboratories

Research Institutes

Others

Regional Outlook (Revenue, USD Million, 2015 - 2027)

North America

U.S.

Canada

Europe

Germany

U.K.

Asia Pacific

Japan

China

Latin America

Brazil

Mexico

中东和非洲

South Africa

Saudi Arabia

Frequently Asked Questions About This Report

b.的global medical waste containers market size was estimated at USD 1.64 billion in 2019 and is expected to reach USD 1.72 billion in 2020.

b.的global medical waste containers market is expected to grow at a compound annual growth rate of 6.1% from 2020 to 2027 to reach USD 2.61 billion by 2027.

b.North America dominated the medical waste containers market with a share of 45.34% in 2019. This is attributable to an increase in the number of surgeries, healthcare workers, rising cases of hospital-acquired infections, and the outbreak of COVID-19.

b.Some key players operating in the medical waste containers market include BD, Bemis Manufacturing Company, Mauser Packaging Solutions, Bondtech Corporation, and Thermo Fisher Scientific Inc.

b.Key factors that are driving the medical waste containers market growth include increasing patient population, the rising volume of diagnostic and lab testing samples, and growing awareness of the benefits of hospital waste management in curbing the spread of infection.