Penile Implants Market Size, Share & Trends Analysis Report By Type (Inflatable, Non-inflatable), By End-use (Hospital, Ambulatory Surgery Centers), By Region (North America, Europe, APAC, Latin America, MEA), And Segment Forecasts, 2020 - 2027

- Report ID: GVR-4-68038-918-0

- Number of Pages: 150

- Format: Electronic (PDF)

- Historical Range: 2016 - 2018

- Industry:Healthcare

Report Overview

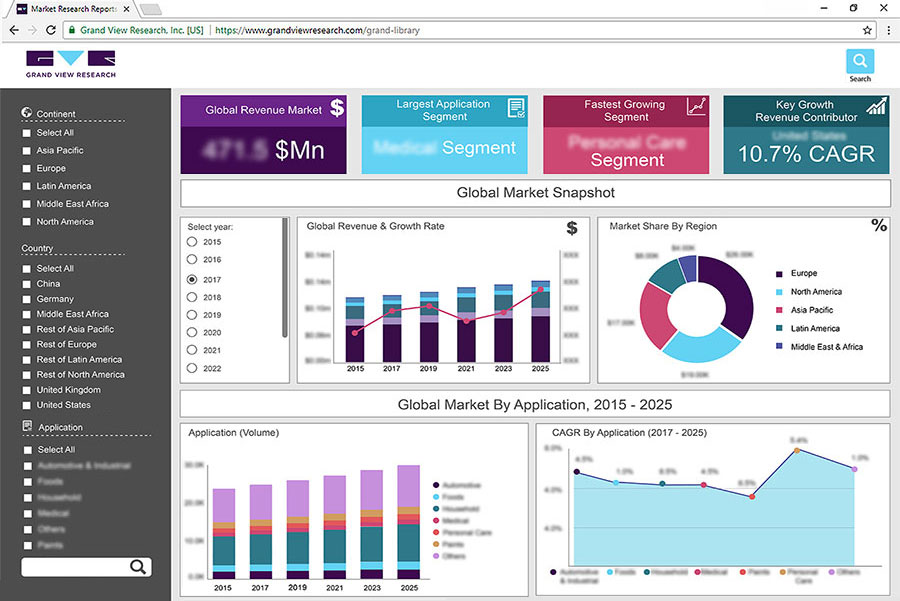

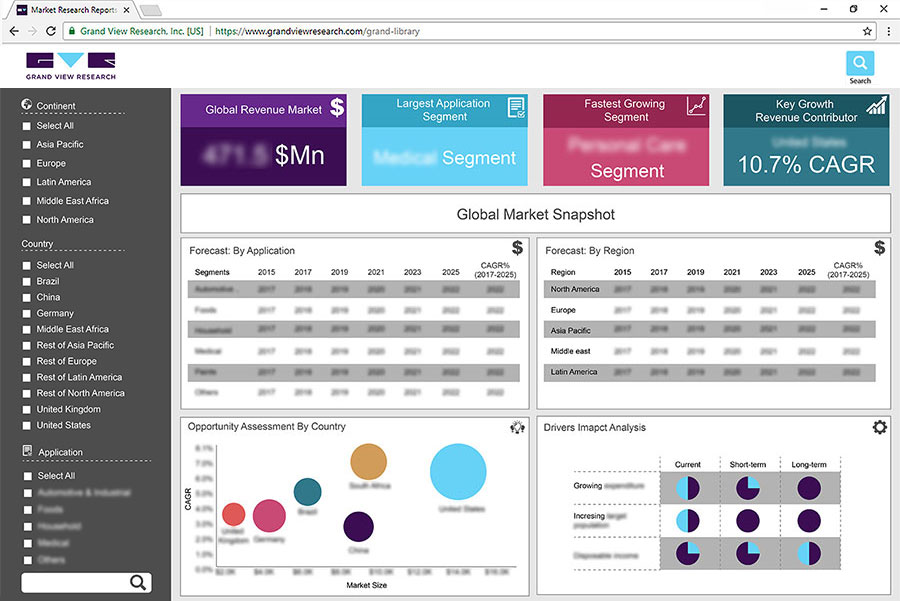

The global penile implants market size was valued at 452.2 million in 2019 and is expected to grow at a compound annual growth rate (CAGR) of 4.5% from 2020 to 2027. Increasing incidence of Erectile Dysfunction (ED) disorder as a symptom of associated comorbidities such as diabetes, renal disease, liver disorder, vascular conditions, and atherosclerosis, is a key factor driving the market for a penile implant. In addition, changes in lifestyle, high prevalence of tobacco smoking, and increasing patient awareness towards available options such as penile prosthesis and implants are other factors boosting the market for a penile implant. Technological advancements, increasing adoption of Minimally Invasive Surgeries (MIS), and high disposable income are some of the factors responsible for market growth.

Penile prostheses, also known as penile implants (both inflatable and non-inflatable) are standard care in the management of ED. There has been a significant increase in the demand for surgical treatment of ED with the penile implant as such procedures are less traumatic and facilitate faster recovery. Moreover, surgeries performed in ambulatory surgical centers are gaining traction attributed to factors like patient satisfaction and cost-effectiveness.

Type Insights

The inflatable penile implant segment held almost 60.0% of revenue share in 2019 and is expected to grow at a lucrative rate during the forecast period. Decreased malfunction rates, lower rates of associated infections, and high rates of patient satisfaction are key factors boosting segment growth.

In regions like Europe and the Asia Pacific, malleable devices are often used due to cost and reliability issues. But the demand for inflatable devices is increasing rapidly attributed to durability and prone to any infections. The manufactures are developing inflatable penile implants which are cost-effective, more durable, and flexible components. The remote-controlled and heat-activated penile implants are some innovations being developed by the companies.

End-use Insights

The hospital dominated the end-use segment with the highest market share of around 55.0% in 2019. With the majority of inflatable penile prosthesis procedures conducted in inpatient or outpatient facilities of the hospital, the hospital segment dominates the penile implant market.

With the shifting patient trends towards day surgery andambulatory surgery center, many of the penile procedures are being carried out in the ASC setting and other urology centers and thus the ASC segment is expected to witness high growth over the forecast period.

区域的见解万博赛事直播客户端

North America dominated the market for penile implants and accounted for a revenue share of more than 67.0% in 2019. Presence of sophisticated healthcare facilities, growing demand for surgical treatment options for extended sex life, availability of highly advanced equipment & skilled urologists in the region, rise in the preference for outpatient settings for MIS procedures, and supportive reimbursement framework for medical treatments are among the factors driving the growth of the market in the region.

In Europe, the market is anticipated to grow significantly over the forecast period. High incidence of various urological disorders and rising prevalence of chronic diseases due to unhealthy lifestyles are among the major factors driving the market in the region. The Asia Pacific penile market is expected to grow at with the highest CAGR attributed to growing awareness towards penile procedures and a large population suffering from ED, and availability of advanced tools and equipment in many countries to carry out the procedures on an outpatient basis.

Key Companies & Market Share Insights

阴茎的市场implants is highly competitive in nature due to the presence of multiple players in the market. Players like Coloplast, Boston Scientific, Rigicon Inc., Zephyr Surgical Implants (ZSI) are among the major players operating in the market for a penile implant. Boston Scientific’s AMS 700 and Rigicon’s Infla10 are the most common inflatable three-piece implants used for the surgery. Technological advancements, new product launches and strategic partnerships for geographical expansions are the key strategies followed by key market players. The companies are focused on the development of technologically advanced products with greater efficiency & improved design. Some of the prominent players operating in the penile implants market include:

Zephyr Surgical Implants

Boston Scientific Corporation

Coloplast

Promedon

Rigicon Inc.

Penile Implants Market Report Scope

Report Attribute |

Details |

Market size value in 2020 |

USD 469.8 million |

Revenue forecast in 2027 |

USD 640.5 million |

Growth rate |

CAGR of 4.5% from 2020 to 2027 |

Base year for estimation |

2019 |

Historical data |

2016 - 2018 |

Forecast period |

2020 - 2027 |

Quantitative units |

Revenue in USD million and CAGR from 2016 to 2027 |

Report coverage |

Revenue forecast, company position, competitive landscape, growth factors, and trends |

Segments covered |

Type, end-use, region |

区域范围 |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

国家范围 |

The U.S.; Canada; The U.K.; Germany; France; Italy; Spain; China; Japan; Brazil; Mexico; South Africa |

Key companies profiled |

Zephyr Surgical Implants; Boston Scientific Corporation; Coloplast; Promedon; Rigicon Inc. |

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope. |

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs.Explore purchase options |

Segments Covered in the Report

This report forecasts revenue growth at regional levels and provides an analysis of the industry trends in each of the sub-segments from 2016 to 2027. For the purpose of this study, Grand View Research has segmented the global penile implants market report based on type, end-use, and region:

Type Outlook (Revenue, USD Million, 2016 - 2027)

Inflatable penile implant

Non-inflatable/malleable penile implant

End-use Outlook (Revenue, USD Million, 2016 - 2027)

Hospital

日间手术中心(ASC)

Others

Regional Outlook (Revenue, USD Million, 2016 - 2027)

North America

The U.S.

Canada

Europe

The U.K.

Germany

France

Italy

Spain

Asia Pacific

China

Japan

Latin America

Brazil

Mexico

Middle East & Africa

South Africa

Frequently Asked Questions About This Report

b.The global penile implants market size was estimated at USD 452.2 million in 2019 and is expected to reach USD 469.8 million in 2020.

b.The global penile implants market is expected to grow at a growth rate of 4.5% from 2020 to 2027 to reach USD 640.5 million by 2027.

b.North America dominated the global penile implants market with the highest share of 68% in 2019. This is attributed to the rising demand for erectile dysfunction devices among the patients in the U.S.

b.Some key players operating in the penile implants market include Boston Scientific, Coloplast Corp, Gust, Inc., Promedon, Zephyr Surgical Implants, Pos-T-Vac, Inc., Reflexonic, LLC, Owen Mumford Ltd, Vacurect Manufacturing (Pty) Ltd., Silimed, and Eska Medical Gmbh.

b.Key factors driving the penile implants market growth include rising incidence of erectile dysfunction and increasing awareness about penile diseases and advanced products in the market.