Pet Monitoring Camera Market Size, Share & Trends Analysis Report By Product (One-way Video Functionality, Two-way Video Functionality), By Distribution Channel (Offline, Online), By Region, And Segment Forecasts, 2019 - 2025

- Published Date: Aug 2019

- Report ID: GVR-3-68038-439-0

- Number of Pages: 80

- Format: Electronic (PDF)

- Historical Data: 2015 - 2017

Industry Insights

The global pet monitoring camera market size was valued at USD 49.5 million in 2018. Increasing pet ownerships, especially among millennials is driving the product demand. Furthermore, rising spending on pet accessories and monitoring devices supported by the increased purchasing power of consumers has been fueling the growth of the market.

照顾同伴动物是有压力的working population due to busy work schedule. As a result, the companion animals are at the risk of suffering from depression and loneliness when they stay at home alone. Monitoring cameras have been increasingly gaining popularity among consumers for keeping an eye on their pets at home. These products are mainly used for interacting, training, monitoring, treating, and entertaining pets.

The pet monitoring camera market has gained significant traction in the developed countries from North America and Europe. Increased number of dual-income households allows the consumers to spend more on their companion animals. Rising concern about the safety coupled with trend of adopting pets is projected to propel the market growth. Furthermore, the continuous rise in the number of millennial pet owners along with adoption of advanced technologies has been driving the market growth.

Rise in digital marketing, improved distribution channels, social media promotions, and easy internet access have also been contributing to the growth of the market. The high prices of pet monitoring cameras may hinder the adoption rate in the near future. A large number of pet owners belonging to the middle-income group hesitate to install these cameras owing to their high prices. Most of the products require continuous cloud connectivity, which is an issue in several developing countries such as Indonesia, India, and Malaysia.

Distribution Channel Insights

Offline distribution channel held the largest market share of more than 85% of the total revenue in 2018. Growing penetration of hypermarkets and supermarkets has been strengthening the offline retail segment. Over the past few years, producers have started using a hybrid business model that incorporates online retails along with physical stores to cater to a larger consumer base.

The online distribution channel is expected to witness the fastest CAGR of over 28% from 2019 to 2025. The rapid growth of e-commerce in consumer electronics industry is expected to enhance the online sale of pet monitoring cameras in the upcoming years. In 2018, Amazon led online sale of the pet products. PetSmart Inc.; Walmart; Petco Animal Supplies, Inc.; Target Brands, Inc.; eBay Inc.; and Costco Wholesale Corporation are some other major e-commerce retailers in the industry. In May 2017, PetSmart Inc. acquired Chewy, Inc. for USD 3.35 billion to strengthened its presence in the e-commerce industry.

Product Insights

In 2018, the one-way video functionality products held the largest market share of more than 85%. These products allow live streaming of HD video with sound and recording video clips of the pet on smartphones. Most of the products have either one-way or two-way voice communication that allows owners to interact with the pets. Over the past few years, manufacturers have added several innovative functions to their products, including automatic treat dispenser, laser dot chase game, customizable built-in ringtone, motion and sound detection capabilities, temperature monitoring, and snapshots capturing. These features attract consumers seeking better interaction with their pets.

双向视频功能段我的产品s expected to witness the fastest CAGR of 26.7% from 2019 to 2025. These products have been gaining significant popularity among consumers due to the rising demand for multi-purpose monitoring devices. These devices help the owners to visually interact with their pets and feeding them at appropriate times, making them play, and entertaining them. In 2014, PetChatz launched its two-way premium audio and HD video camera that featured with two-way video chats, treat dispense, entertainment with DOGTV, brain games, pet to parent messaging (pawcall) and calming aromatherapy. These types of products have gained significant popularity among consumers owing to their innovative features.

Regional Insights

In 2018, North America led the market, contributed to more than 50% of the global revenue share. Presence of a large number of pet owning households along with the high purchasing power of the consumers has been fueling the regional market growth. According to the American Pet Products Association, Inc., around 68% of the U.S. households owned a pet in 2018. Over the past few years, the expenditure on this segment has been increasing significantly. In 2018, the expenditure on domestic animals had crossed USD 72 billion in the U.S. More than 60 million households own a dog and over 45 household owns a cat in the country.

亚太地区预计to witness the fastest CAGR of over 26% from 2019 to 2025. Rapid urbanization has been speeding up the regional adoption of companion animals. The spending on domestic animals has been rising in countries including China, Japan, Australia, and India. For instance, in Australia, 76% of dogs and 92% of cats are pets, which indicates a significant demand for monitoring camera in the country.

Pet Monitoring Camera Market Share Insights

Key manufacturers include Guardzilla; Wagz, Inc.; Tomofun (Furbo Dog Camera); Motorola, Inc.; Petcube, Inc.; Zmodo; Acer Inc. (Pawbo Inc.); Anser Innovation LLC (PetChatz); Hangzhou Hikvision Digital Technology Co., Ltd. (Ezviz Inc.); and Vimtag Technology Co., Ltd. Over the past few years, manufacturers have been collaborating with professional trainers and behaviorists to improve their products. For instance, in July 2018, Petcube collaborated with Cesar Millan, a dog trainer, to improve their product with the help of the knowledge about the relationship between pets and their owners. Manufacturers have been introducing technologically advanced and innovative products to cater to the larger consumer base and to gain a competitive advantage.

Report Scope

Attribute |

Details |

Base year for estimation |

2018 |

Actual estimates/Historical data |

2015 - 2017 |

Forecast period |

2019 - 2025 |

Market representation |

Revenue in USD Thousand and CAGR from 2019 to 2025 |

Regional scope |

North America, Europe, Asia Pacific, Central & South America, Middle East & Africa |

Country scope |

U.S., Germany, U.K., China, India, Brazil, South Africa |

Report coverage |

Revenue forecast, company share, competitive landscape, and growth factors and trends |

15% free customization scope (equivalent to 5 analyst working days) |

If you need specific information, which is not currently within the scope of the report, we will provide it to you as a part of customization |

Segments Covered in the Report

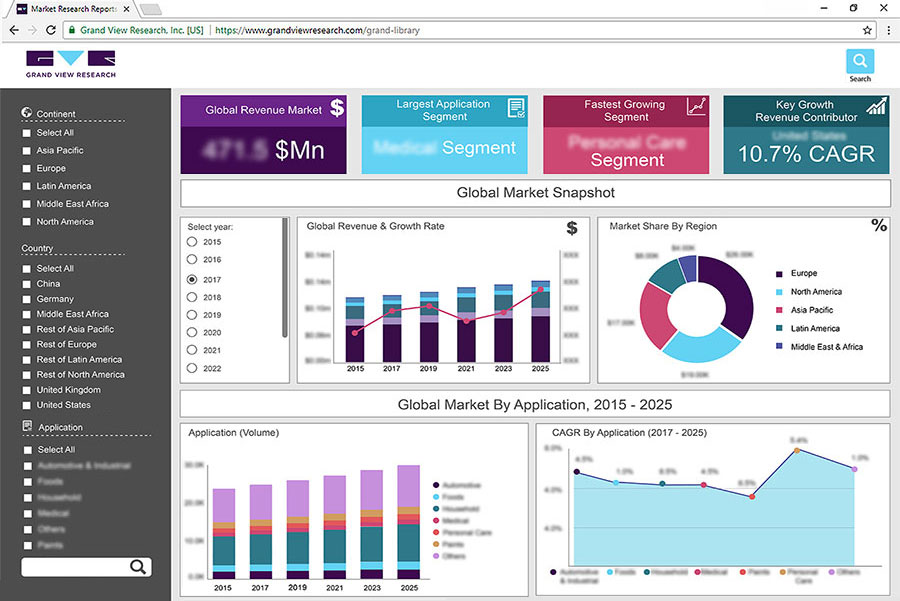

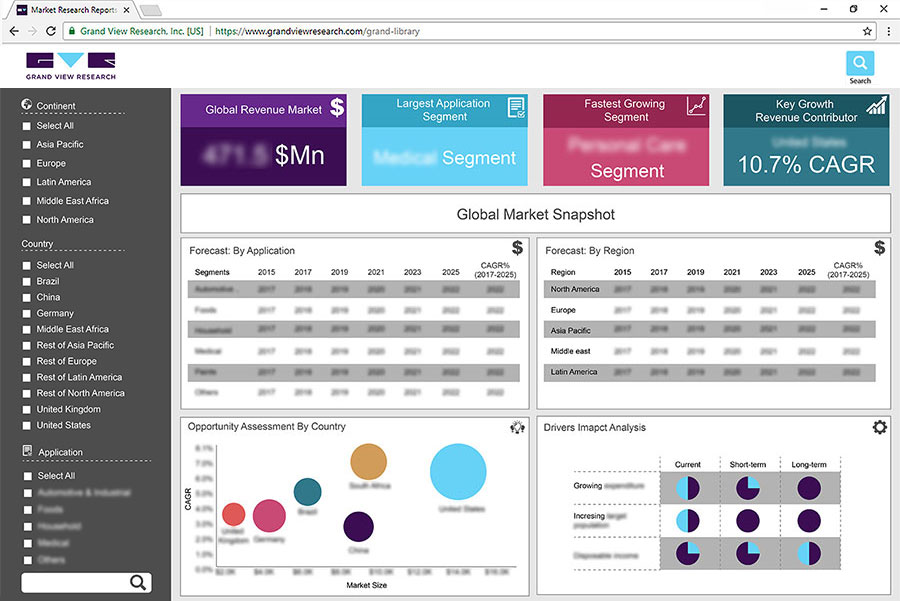

This report forecasts revenue growth at global, regional, and country levels, and provides an analysis of the latest industry trends in each of the sub-segments from 2015 to 2025. For the purpose of this study, Grand View Research has segmented the global pet monitoring camera market report based on product, distribution channel, and region:

Product Outlook (Revenue, USD ‘000, 2015 - 2025)

One-way Video Functionality

Two-way Video Functionality

Distribution Channel Outlook (Revenue, USD ‘000, 2015 - 2025)

Offline

Online

Region Outlook (Revenue, USD ‘000, 2015 - 2025)

North America

The U.S.

Europe

Germany

The U.K.

Asia Pacific

China

Japan

Central & South America

Brazil

Middle East & Africa

South Africa