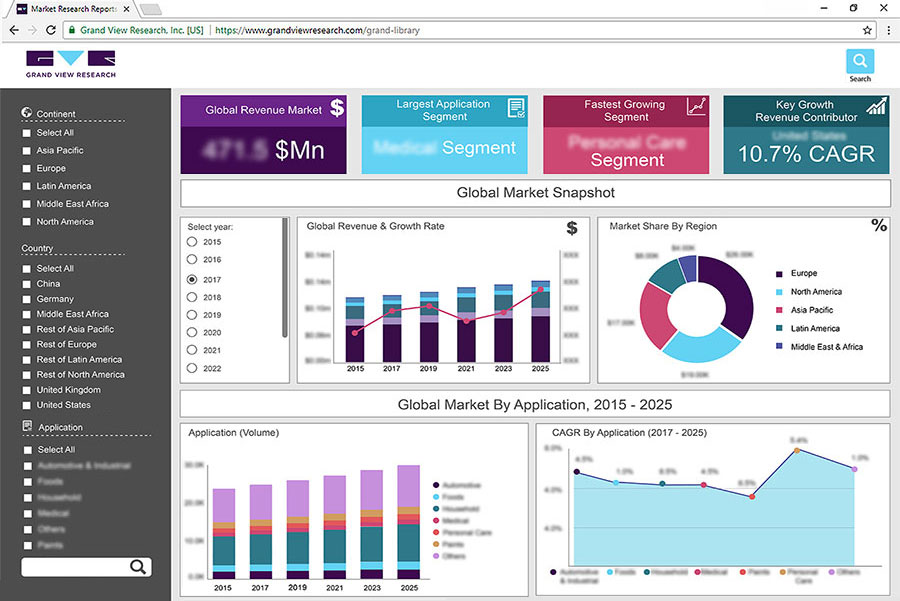

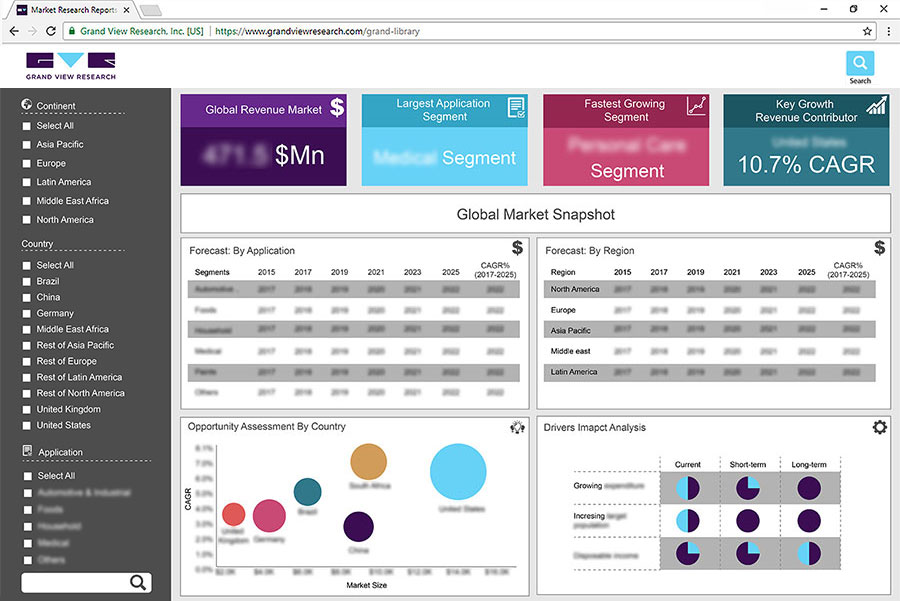

Plastic Furniture Market Size, Share & Trends Analysis Report By Application (Residential, Commercial), By Distribution Channel (Online, Offline), By Region, And Segment Forecasts, 2019 - 2025

- Report ID: GVR-3-68038-367-6

- Number of Pages: 80

- Format: Electronic (PDF)

- Historical Range: 2015 - 2017

- Industry:Consumer Goods

Report Overview

The global plastic furniture market size was valued at USD 11.9 billion in 2018 and is expected to expand at a CAGR of 3.9% from 2019 to 2025. The market growth is attributed to factors like affordability, durability, lightweight, low or no maintenance, eco-friendly, resistant to corrosion, no effect of termites and bugs, good weather ability, and flexibility.

Growing real estate and hospitality sector through various residential and commercial projects is boosting the product demand. Demand for versatile, lightweight, flexible, and multi-functional furniture offering easy portability and application in small as well as large space is expected to drive the global plastic furniture market.

Due to the growing trend of nuclear families, the demand for easy moving and portable furniture is increasing in compact and integrated modular homes. A wide range of products as per the application and demand of the consumers are available due to the ease of molding, designing, and shaping, which provides consumers a wide scope for purchasing.

Many manufacturers are inclined towards developing eco-friendly furniture due to increasing awareness among consumers regarding eco-friendly products. Globally expanding trend to go green will substantially increase demand for ecological plastic furniture over the forecast period. Growing environmental concerns across the world over deforestation is expected to surge the product demand.

Recycled plastic furniture made from plastic waste such as bottles and ocean plastic finds a wide application in outdoor furniture. For Instance, ScanCom International A/S, a furniture company based in Denmark, launched DuraOcean and DuraLand, a line of furniture made completely from the ocean and land waste to manufacture 100% recycled product.

One of the major restraining factors for market growth is lack of characteristics and elegance like wood and metal. Plastic furniture can limit consumer’s preference regarding design and aesthetic but not in case of colors as many manufacturers stick to the similar molding of PVC. As a result, this furniture has less demand in the luxury furniture segment.

Moreover,plastic不可生物降解的产品有害的英孚吗fects on the environment, which is expected to act as a restraint to the market growth. The strength of plastic furniture is also one of the restraining factors for market growth as it is weaker as compared to other furniture.

Application Insights

By application, the market is segmented into residential and commercial. The residential segment accounted for the largest market share in 2018 and is estimated to witness the fastest growth over the forecast period. The growth is attributed to factors such as increasing demand from low-medium income population, growing preference for a playroom, rapid urbanization, soft and safe children furniture, and surging demand for outdoor furniture. The residential segment is anticipated to proliferate over the forecast period owing to growing real estate projects imitated by the government in the rural and urban areas, leading to an increase in demand for furniture in the living room and bedroom.

The commercial segment is estimated to witness significant growth over the forecast period owing to the growing economy resulting in growing office space, tourism, and mid-scale restaurant and hotel industry. Demand for plastic furnishings such as chairs and tables in large scale events on a contract basis is expected to drive the market. However, in commercial real estate, demand for metal and wood furniture is high as it offers elegance and aesthetics to the infrastructure over plastic furniture.

Distribution Channel Insights

By distribution channel, the market is segmented as online and offline. An online distribution channel is estimated to be the fastest-growing segment in the forecast period owing to the availability of a wide range of products, discounts on product, the convenience of purchasing, easy comparison, and access to different sizes and colors.

For instance, the world’s largest furniture retailer, IKEA witnessed a 31% growth in online sales. Moreover, easy return and delivery make it more convenient for consumers to purchase the furniture. Delivery types such as front door delivery, inside delivery, and white glove delivery make the shipping of furniture more easy and safe.

The offline distribution channel accounted for the largest market share in 2018 and is expected to witness significant growth over the forecast period. Traditionally, consumers prefer to buy furniture from the stores to assess the product and feel the aesthetic and size. However, manufactures nowadays are changing the way consumers are shopping for furniture.

Augmented realityandvirtual realityare the upcoming trends in the offline segment, where consumers can check if the product fits the consumer’s requirement. For instance, Macy’s has launched VR furniture shopping experience in about 70 stores nationwide, allowing shoppers to design space with 3D furniture image, thus changing the purchasing experience of the consumers.

Regional Insights

The Asia Pacific emerged as the largest regional market in 2018 and is expected to witness the fastest growth over the forecast period. Factors such as the growing low-mid income population, large number of households, and growing IT sector and office space are expected to positively impact the market demand in the region.

The residential sector holds the largest market share in the region due to the growing residential infrastructure. In the Asia Pacific, India is the fastest and largest growing market owing to affordability, the presence of leading manufacturers such as Nilkamal and Featherlite, and increasing demand from the residential and commercial sectors.

The Middle East and Africa are expected to witness significant growth in the forecast period owing to the increasing focus of the government on real estate through various commercial and residential projects to boost economic growth, especially in Saudi Arabia. This is expected to increase the market demand in the commercial as well as residential sectors.

Key Companies & Market Share Insights

Some of the major market players operating in the global industry are Tramontina, Cosmoplast Industrial Company L.L.C., Supreme Group, Cello Wim Plast Ltd., Nilkamal Furniture, Avon Furniture Factory L.L.C, Keter Group, Vitra International AG, Patio Furniture Industries, and UMA Plastics Limited.

Players in the industry are investing in research and development to increase sustainability and foothold in the market. For instance, ecoBirdy, a Belgium based Furniture Company, recycle discarded plastic toys to manufacture furniture, specially designed for kids.

Plastic Furniture Market Report Scope

Report Attribute |

Details |

The market size value in 2020 |

USD 12.89 billion |

The revenue forecast in 2025 |

USD 15.48 billion |

Growth Rate |

CAGR of 3.9% from 2019 to 2025 |

The base year for estimation |

2018 |

Historical data |

2015 - 2017 |

Forecast period |

2019 - 2025 |

Quantitative units |

Revenue in USD million/billion and CAGR from 2019 to 2025 |

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

Segments covered |

Distribution channel, application, region |

Regional scope |

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa |

Country scope |

U.S.; U.K.; France; China; India; Brazil; Saudi Arabia |

Key companies profiled |

Tramontina; Cosmoplast Industrial Company L.L.C.; Supreme Group; Cello Wim Plast Ltd.; Nilkamal Furniture; Avon Furniture Factory L.L.C; Keter Group; Vitra International AG; Patio Furniture Industries; UMA Plastics Limited |

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

革命制度党cing and purchase options |

Avail customized purchase options to meet your exact research needs.Explore purchase options |

Segments Covered in the Report

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2015 to 2025. For this study, Grand View Research has segmented the global plastic furniture market report based on distribution channel, application, and region:

Distribution Channel Outlook (Revenue, USD Million, 2015 - 2025)

Online

Offline

Application Outlook (Revenue, USD Million, 2015 - 2025)

Residential

Commercial

Regional Outlook (Revenue, USD Million, 2015 - 2025)

North America

The U.S.

Europe

U.K.

France

Asia Pacific

India

China

Central & South America

Brazil

Middle East & Africa (MEA)

Saudi Arabia

Frequently Asked Questions About This Report

b.The global plastic furniture market size was estimated at USD 12.37 billion in 2019 and is expected to reach USD 12.89 billion in 2020.

b.The global plastic furniture market is expected to grow at a compound annual growth rate of 3.9% from 2019 to 2025 to reach USD 15.48 billion by 2025.

b.Asia Pacific dominated the plastic furniture market with a share of 39.7% in 2019. This is attributable to factors such as growing low-mid income population, large number of households, and growing IT sector and office spaces in the region.

b.Some key players operating in the plastic furniture market include Tramontina, Cosmoplast Industrial Company L.L.C., Supreme Group, Cello Wim Plast Ltd., Nilkamal Furniture, Avon Furniture Factory L.L.C, Keter Group, Vitra International AG, Patio Furniture Industries, and UMA Plastics Limited.

b.Key factors that are driving the market growth include product properties such as affordability, durability, lightweight, low or no maintenance, eco-friendly, resistant to corrosion, no effect of termites and bugs, good weatherability, and flexibility.