Smart Insulin Pens & Pumps Market Size, Share & Trends Analysis Report By Product (MiniMed, Accucheck, Tandem, Omnipod, Inpen, Pendiq 2.0), By End Use, By Region, And Segment Forecasts, 2019 - 2026

- Report ID: GVR-4-68038-151-1

- Number of Pages: 110

- Format: Electronic (PDF)

- Historical Range: 2015 - 2017

- Industry:Healthcare

Report Overview

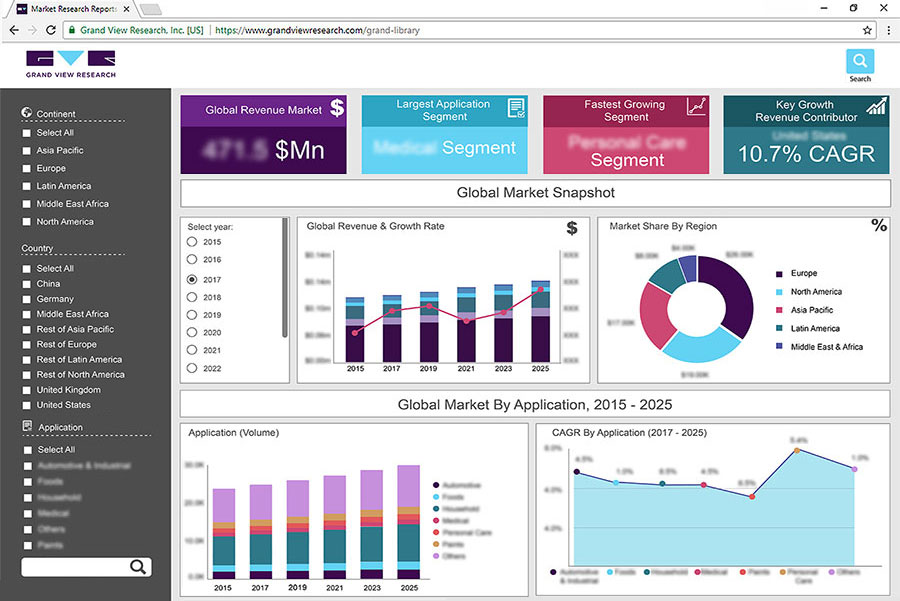

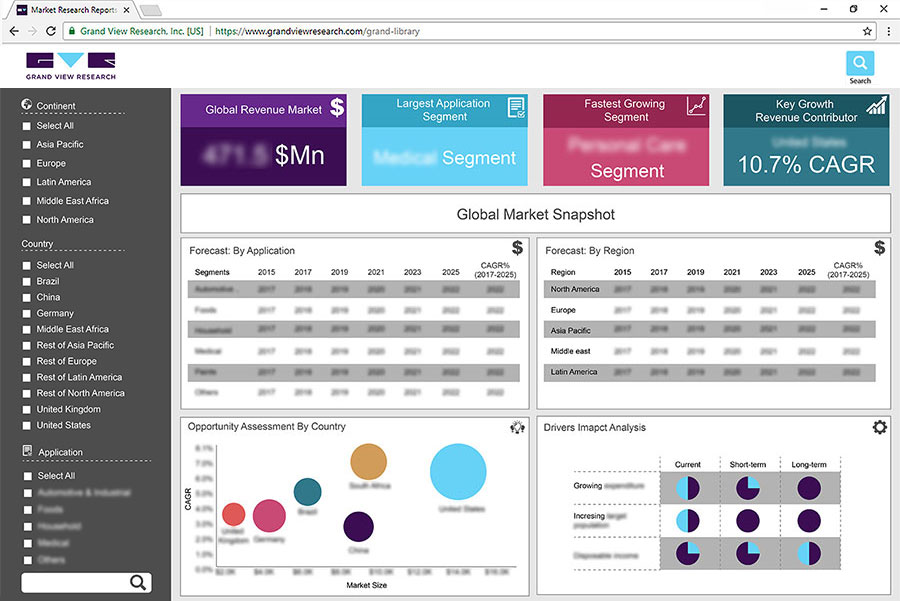

The global smart insulin pens and pumps market size valued at USD 2.5 billion in 2018 and is expected to grow at a compound annual growth rate (CAGR) of 10.0% from 2019 to 2026. The key market drivers include technological advancements and rapid adoption of smart insulin devices among diabetes patients. High demand for patient convenient products is driving the demand for technologically advanced products. Furthermore, rising awareness about advanced diabetic management tools is expected to fuel the market growth during the forecast period.

Frequent product launches and approvals from the Food and Drug Administration (FDA) for smart insulin delivery devices in the recent years is anticipated to continue driving the product demand. For instance, in 2016, the U.S. FDA approved Medtronic’s MiniMed 670G. It was claimed to be the world’s first hybrid closed-loop system. With the advent ofArtificial Intelligence(AI) and data analytics approach, the market is expected show a hinge effect and help millions of patients in convenient blood glucose management. However, the high price of these advanced devices is likely to slower growth of the smart insulin pens and pumps market in developing countries.

Rising government initiatives and widening margins of healthcare spending are some of the factors significantly impacting the demand of smart diabetes management solutions. In the U.S., healthcare spending on diabetes has increased substantially over the last two decades. According to The American Diabetes Association, these spending increased from USD 37 billion in 1996 to USD 101 billion in 2013. In addition, prevalence of diabetes reached 9.2% in 2015 from 5.8% in 1990. In addition, according to The International Diabetes Federation, approximately 463 million adults are living with diabetes and this number is expected to reach 700 million by 2045.

Smart insulin pens and pumps have set new milestones for advanced diabetes care solutions. These devices provide data that allows users to monitor blood glucose level in real-time. These devices enable users to access information which help them to take effective decision regarding their medication and food intake. Moreover, smart insulin pens and pumps allow users to customize the device to achieve their personal goal for diabetes management.

Product Type Insights

Based on the product, the market is segmented into smart insulin pumps and pens. The pens segment is expected to register the fastest CAGR during the forecast period. , primarily attributed to the continuous technological advancements and launch of advanced products. For instance, in December 2017, companion medical, a leader in development of diabetes management announced the commercial sales of Inpen in the U.S. This is the first and only FDA approved solution that can integrate insulin pen with smart phone app.

The smart insulin pumps segment is dominating the market and is expected to expand at a CAGR of 9.9% during the forecast period. The key segment drivers include increasing product adoption and rapid technological advancements. Wide product pipeline and positive results inclinical trialsare the factors expected to further propel the growth. For instance, in June 2019, Medtronic launched its in home trial of 780G an advanced hybrid closed loop system. The trial is estimated to be completed in 2020, with the result expected to be presented by July 2020.

Based on product, smart insulin pump segment is divided into Medtronic (670G and 630G), Roche (Accu-check Combo and Spirit), Tandem Diabetes Care (T slim X2 and G4), Insulet Corporation (Omnipod), ypsomed AG (Mylife Omnipod), and others. MiniMed insulin pump segment is anticipated to continue dominating the market in near future, owing high market presence and continuous technological advancements. The growth is primarily driven by the launch of its 670G closed loop system which can work as an artificial pancreas.

Smart Insulin pens segment is further divided into Inpen, pendiq 2.0, Novo6, Novo Echo Plus, ESYTA Pen, and others. Companion Medical Inpen dominated the market in 2018, owing to high product adoption. This smart pen comes with a smartphone app with bolus advisor that works with the help of Bluetooth. One of the most popular features of Inpen is its ability to dispense Humalog or Novolog in half-unit increments. Moreover, it reduces guesswork when it comes to take dose of fast acting insulin. The smart insulin pens segment is expected to see disruption as many new products are going to launch in the near future. For instance, in May 2019, Novo Nordisk have also announced to bring wireless pens to the U.S. Market.

End-use Insights

The hospitals and clinics segment accounted for the largest market share of more than 40% in 2018 and is expected to grow at a lucrative rate during the forecast period. Growing number of hospitals along with the rise in healthcare spending is anticipated to fuel the segment growth. According to the American Medical Association, healthcare spending to hospital care accounted for the largest market share in 2018.

Homecare segment is expected to register the fastest CAGR during the forecast period, majorly attributed to the factors, such as increasing awareness about self-blood glucose monitoring devices and rising adoption of smart devices. Furthermore, factors such as rising cost of healthcare services and hospital charges are also pushing patients to use medical devices at home.

Regional Insights

North America lead the market in 2018 owing to the presence of major players along with many product launches. Factors such as rising prevalence of diabetes and high cost of smart insulin pumps are also expected to contribute to the regional market growth. Europe is expected to follow North America with largest market share due to presence of many products and major market players strategizing with technological collaborations. For instance, in November 2018, Diabeloop S. A, a manufacturer, and supplier ofdiabetes devices, received CE approval for its artificial pancreas system named DBLG1.

Asia Pacific (APAC) is projected to provide lucrative growth opportunities for the international market players. Increasing healthcare spending and favorable government initiatives to spread awareness about advanced diabetes management solutions are the major factors aiding the regional market growth. China dominating the APAC region in 2018 owing to the presence of a large diabetes population pool and increasing foreign direct investment in the country. For instance, in January 2016, Medtronic partnered with Chinese government to manufacture insulin pumps. The deal shared a commitment to transfer diabetes care through advanced therapies.

Key Companies & Market Share Insights

Major players are focusing on technological collaboration and product launches. For instance, in 2018, Tandem Diabetes Care Inc., launched the t: slim X2 insulin pump with Basal- IQ Technology, integrated with the Dexcom CGM System. Some of the prominent players in the smart insulin pens and pumps market include:

Companion Medical Inc.

Novo Nordisk

Emperra Gmbh E-Health technologies

Jiangasu Delfu medical device Co Ltd

Insulet Corporation

Cellenovo

Medronic Inc.

F Hoffmann-La Roche

Ypsomed

Tandem Diabetes Care

Sooil Development

ValeritasInc.

Smart Insulin Pens & PumpsMarket Report Scope

Report Attribute |

Details |

Market size value in 2020 |

USD 3.4 billion |

Revenue forecast in 2026 |

USD 6.2 billion |

Growth Rate |

CAGR of 10.0% from 2019 to 2026 |

Base year for estimation |

2018 |

Historical data |

2015 - 2017 |

Forecast period |

2019 - 2026 |

Quantitative units |

Revenue in USD million and CAGR from 2019 to 2026 |

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

Segments covered |

Type, end-use, region |

Regional scope |

北美;欧洲;亚太地区;拉丁美洲; MEA |

Country scope |

U.S.; Canada; U.K.; Germany; France; Italy; Spain; China; Japan; India; Australia; South Korea; Mexico; Brazil; Colombia; Argentina; South Africa; Saudi Arabia; UAE |

Key companies profiled |

Companion Medical Inc.; Novo Nordisk; Emperra Gmbh E-Health technologies; Jiangasu Delfu medical device Co Ltd; Insulet Corporation; Cellenovo; Medronic Inc.; F Hoffmann-La Roche; Ypsomed; Tandem Diabetes Care; Sooil Development; Valeritas Inc. |

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs.Explore purchase options |

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2015 to 2026. For the purpose of this study, Grand View Research has segmented the global smart insulin pens and pumps market report on the basis of type, end-use, and region:

Product Type Outlook (Revenue, USD Million, 2015 - 2026)

Smart Insulin Pens

Companion Medical (Inpen)

Novo Nordisk (Novo6 and Novo Echo)

Emperra Gmbh (ESYSTA Pen)

Pendiq intelligent diabetes care (Pendiq 2.0)

Others

Smart Insulin Pumps

Minimed (630G and 670G)

Accuchek (Combo and Insight)

Tandem (T:slim X2, and G4)

Omnipod

My Life Omnipod

Others

End-use Outlook (Revenue, USD Million, 2015 - 2026)

Hospitals and Clinics

Homecare

Laboratories

Regional Outlook (Revenue, USD Million, 2015 - 2026)

North America

The U.S.

Canada

Europe

The U.K.

Germany

France

Italy

Spain

Asia Pacific

Japan

China

India

Australia

South Korea

拉丁美洲

Brazil

Mexico

Argentina

Colombia

Middle East & Africa

South Africa

Saudi Arabia

UAE

Frequently Asked Questions About This Report

b.The global smart insulin pens and pumps market size was estimated at USD 3.2 billion in 2019 and is expected to reach USD 3.4 billion in 2020.

b.The global smart insulin pens and pumps market is expected to grow at a compound annual growth rate of 10.0% from 2019 to 2026 to reach USD 6.2 billion by 2026

b.North America dominated the smart insulin pens and pumps market with a share of 47.8% in 2019. This is attributable to the presence of major players along with many product launches.

b.Some key players operating in the smart insulin pens and pumps market include Companion Medical Inc.; Novo Nordisk; Emperra Gmbh E-Health technologies; Jiangasu Delfu medical device Co Ltd; Insulet Corporation;Cellenovo; Medronic Inc.; F Hoffmann-La Roche; Ypsomed; Tandem Diabetes Care; Sooil Development; and Valeritas Inc.

b.Key factors that are driving the market growth include technological advancements and rapid adoption of smart insulin devices among diabetes patients.