Sugar-free Confectionery Market Size, Share & Trends Analysis Report By Product (Sweet & Candy Confectionery, Chocolate Confectionery), By Distribution Channel, By Region, And Segment Forecasts, 2020 - 2027

- Report ID: GVR-4-68038-956-2

- Number of Pages: 80

- Format: Electronic (PDF)

- Historical Range: 2016 - 2018

- Industry:Consumer Goods

Report Overview

全球无糖糖果市场大小佤邦s valued at USD 1.88 billion in 2019 and is expected to grow at a compound annual growth rate (CAGR) of 5.1% from 2020 to 2027. The growth is attributed to the widespread impression that the sugar-free version is healthier than the conventional counterparts. These candies are made using artificial sweeteners orsugar substitutes, such as saccharin, aspartame, sucralose, acesulfame, and neotame, as they are lower in calories. Increasing spending on incorporating sugar alcohol as healthy ingredients in manufacturing confectionery products is expected to remain a key industry trend. Some popular sugar alcohols aremannitol, erythritol sorbitol,xylitol, lactitol, maltitol, and hydrogenated starch hydrolysates. The incorporation of sugar alcohol in the finished products is projected to expand the product scope among people who have diabetes.

Consumption of sugar has been found to have adverse effects on one’s health. Sugar is known to plummet blood glucose levels, which can result in mood swings, fatigue, and headaches. It even enhances cravings and false hunger pangs. Long term consumption of a substantial amount of sugar leads to a higher risk of obesity, heart disease, and diabetes. Various studies in the nascent stage have also found a relation between high-glycemic diets and multiple forms of cancer. It is also known to affect one’s immune system adversely and ultimately reduce the rate of recovery and even cause infection. Together, these are promoting awareness regarding reducing sugar consumption and initiating a preference for sugar-free products.

An increasing number of diabetic cases has also created an enormous opportunity for sugar-free confectionery. According to the National Diabetes Statistics Report, 2020 by the U.S. Department of Health and Human Services, 34.2 million people in the U.S. had diabetes in 2018. It also concluded that the percentage of adults with diabetes increased with age. 21.4% of all the U.S. adults aged 18 years or older suffered from diabetes, in contrast to 26.8% of the population aged 65 years or more.

Over the past few years, health organizations approved the incorporation of sugar substitutes, such as Saccharin, aspartame, acesulfame, sucralose, stevia, sorbitol, and hydrogenated starch hydrolysates. As a result, sugar-free confectionery manufacturers are expected to increase spending on incorporating the above-mentioned alcohol ingredients into the finished goods.

The use of natural sweeteners for sweetening the confectionery is also picking up the pace. Stevia, a sugar substitute, derived from the leaves of Stevia rebaudiana. The active compounds, steviol glycosides, are 30 to 150 times sweeter than sugar. The herbal ingredient has become an essential ingredient for sugar-free organic confectionery. It is a calorie-free alternative, which helps in weight control and contains many sterols and antioxidant compounds known to reduce the risk of pancreatic cancer. Along with that, these are considered safer for teeth as they do not ferment when in contact with oral bacteria and cause erosion and cavities.

Product Insights

Chocolate sugar-free confectionery led the market and accounted for a share of more than 40.0% in 2019. These products are mostly sweetened using maltitol, which is considered safe for diabetic patients. Dark chocolate is a preferred product under this category as the darker the chocolate is, the higher is the content of cocoa in the chocolate, and subsequently, lower is the content of sugars and milk.

无糖糖果segme甜蜜和糖果nt is expected to witness the fastest growth during forecast years with a CAGR of 5.8% from 2020 to 2027. These include a large variety of dragées, fudges, candies, jellies, gummies, gums, peppermints, and toffees. Parents promoting the consumption of these among kids over the conventional confectionery to reduce the risks of decay and erosion of teeth is increasing the demand for the sugar-free products.

Distribution Channel Insights

Hypermarkets and supermarkets accounted for the largest share of more than 35.0% in 2019. This is attributed to the one-stop shopping experience these channels offer to their customers. These big-box stores provide consumers with all the goods they require under one roof. Some of the largest chains are Walmart Supercenter, Fred Meyer, Meijer, and Super Kmart. These hypermarkets and supermarkets have the advantage of selling high volumes of merchandise.

The online and D2C segment is expected to witness the fastest growth during forecast years with a CAGR of 6.4% from 2020 to 2027. The major advantage associated with this distribution channel is that it offers the manufacturers an opportunity to break the physical barriers and establish a large customer base. Furthermore, it reduces the expenses related to building up the physical facility for the shop, and thus ultimately reduces the overall expenses and enhances the profit margin.

Regional Insights

北美的守护神gest share of over 35.0% in 2019. A significant factor influencing the sale of sugar-free confectionery is awareness regarding the adverse effects of skyrocketing consumption of sugar in the U.S. Sugar is known to be the major contributing factor to the rising obesity issue. According to the CDC National Center for Health Statistics, the prevalence of obesity was 42.4% from 2017 to 2018. Thus, people have been trying to cut down the daily sugar intake by preferring sugar-free products.

Asia Pacific is the fastest growing regional market and is expected to expand at a CAGR of 6.3% from 2020 to 2027. According to a report by the World Health Organization, in August 2017, a dramatic increase in diabetes type 2 has been noted. An estimated 96 million people have diabetes in the region, 90% of whom have type 2, which is preventable by a reduction in the consumption of sugar. Thus, sugar-free confectionery is expected to witness a significant opportunity in the region.

Key Companies & Market Share Insights

The market for sugar-free confectionery has been growing rapidly. Product launches have been playing a crucial role in the growth of the market. In February 2020, Beneo unveiled Sweet Collection, a compilation of sugar-free candies that contain authentic flavors. The collection is focused on excitement and authenticity by bringing in a healthy indulgence and sensorial immersion. In order to create the best flavor, the company has collaborated with flavor development partner, Symrise. Local experts from North America, Europe, and Asia contributed to flavor combinations that are preferable in each region. The products involve a variety of exotic and hyper-local ingredients. Some of the prominent players in the sugar-free confectionery market include:

Abdallah Candies Inc.

Asher’s Chocolate Co.

Diabetic Candy.com, LLC

Dr. John's Healthy Sweets LLC

LILY'S SWEETS

ROY Chocolatier

Russell Stover Chocolates, LLC

See's Candy Shops, Inc.

Sugarless Confectionery

The Hershey Company

Sugar-free Confectionery MarketReport Scope

Report Attribute |

Details |

Market size value in 2020 |

USD 1.99 billion |

Revenue forecast in 2027 |

USD 2.81 billion |

Growth Rate |

CAGR of 5.1% from 2020 to 2027 |

Taste year for estimation |

2019 |

Historical data |

2016 - 2018 |

Forecast period |

2020 - 2027 |

Quantitative units |

Revenue in USD million and CAGR from 2020 to 2027 |

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

Segments covered |

Product, distribution channel, region |

Regional scope |

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa |

Country scope |

U.S.; Germany; U.K.; France; China; Japan; India |

Key companies profiled |

Abdallah Candies Inc.; Asher’s Chocolate Co.; Diabetic Candy.com, LLC; Dr. John's Healthy Sweets LLC; LILY'S SWEETS; ROY Chocolatier; Russell Stover Chocolates, LLC; See's Candy Shops, Inc.; Sugarless Confectionery; The Hershey Company |

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs.Explore purchase options |

Segments Covered in the Report

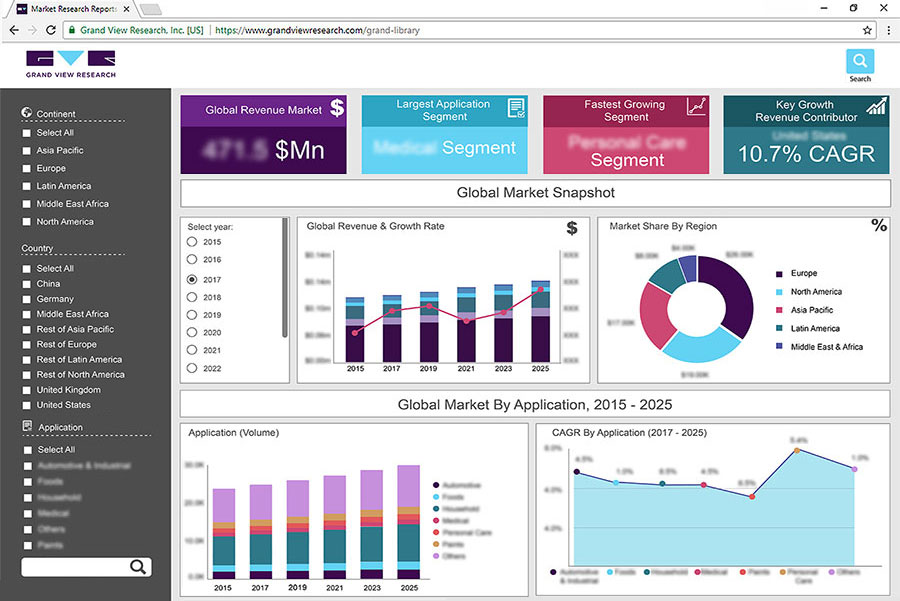

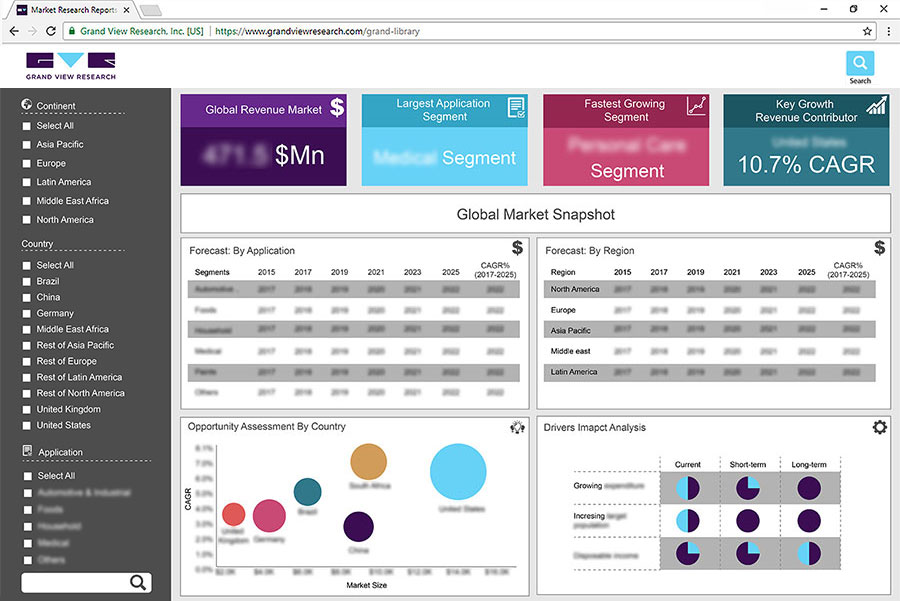

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2016 to 2027. For the purpose of this study, Grand View Research has segmented the global sugar-free confectionery market report on the basis of product, distribution channel, and region:

Product Outlook(Revenue, USD Million, 2016 - 2027)

Sweet & Candy Confectionery

Chocolate Confectionery

Others

Distribution Channel Outlook(Revenue, USD Million, 2016 - 2027)

Hypermarkets & Supermarkets

Convenience & Drug Stores

Online & D2C

Others

Regional Outlook (Revenue, USD Million, 2016 – 2027)

North America

The U.S.

Europe

The U.K.

Germany

France

Asia Pacific

China

Japan

India

Central & South America

Middle East & Africa

Frequently Asked Questions About This Report

b.全球无糖糖果市场大小佤邦s estimated at USD 1.88 billion in 2019 and is expected to reach USD 1.99 billion in 2020.

b.The global sugar-free confectionery market is expected to grow at a compound annual growth rate of 5.1% from 2020 to 2027 to reach USD 2.81 billion by 2027.

b.无糖confectione北美为主ry market with a share of 38.8% in 2019. This is attributable to rising awareness towards a healthy diet among millennials in the U.S. and Canada.

b.Some key players operating in the sugar-free confectionery market include Abdallah Candies Inc., Asher’s Chocolate Co., Diabetic Candy.com, LLC, Dr. John's Healthy Sweets LLC, LILY'S SWEETS, ROY Chocolatier, Russell Stover Chocolates, LLC, See's Candy Shops, Inc., Sugarless Confectionery, and The Hershey Company.

b.Key factors that are driving the market growth include rising awareness regarding sugar-free diet among consumers and new product launches.